4 Batterymarch Park

Quincy Massachusetts,

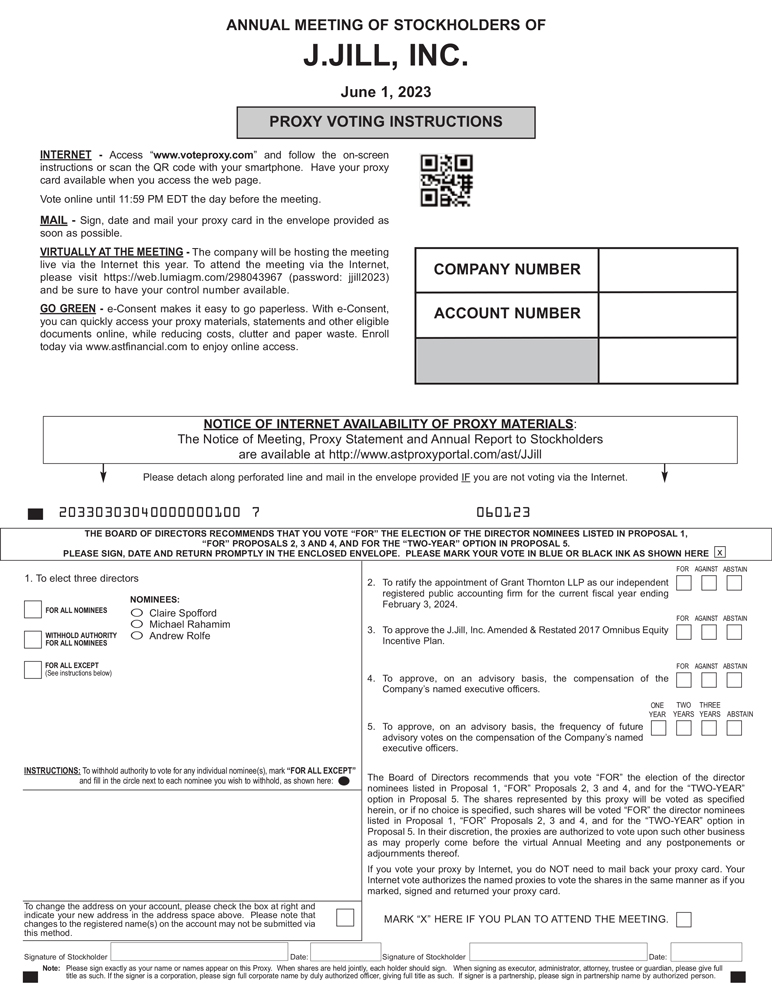

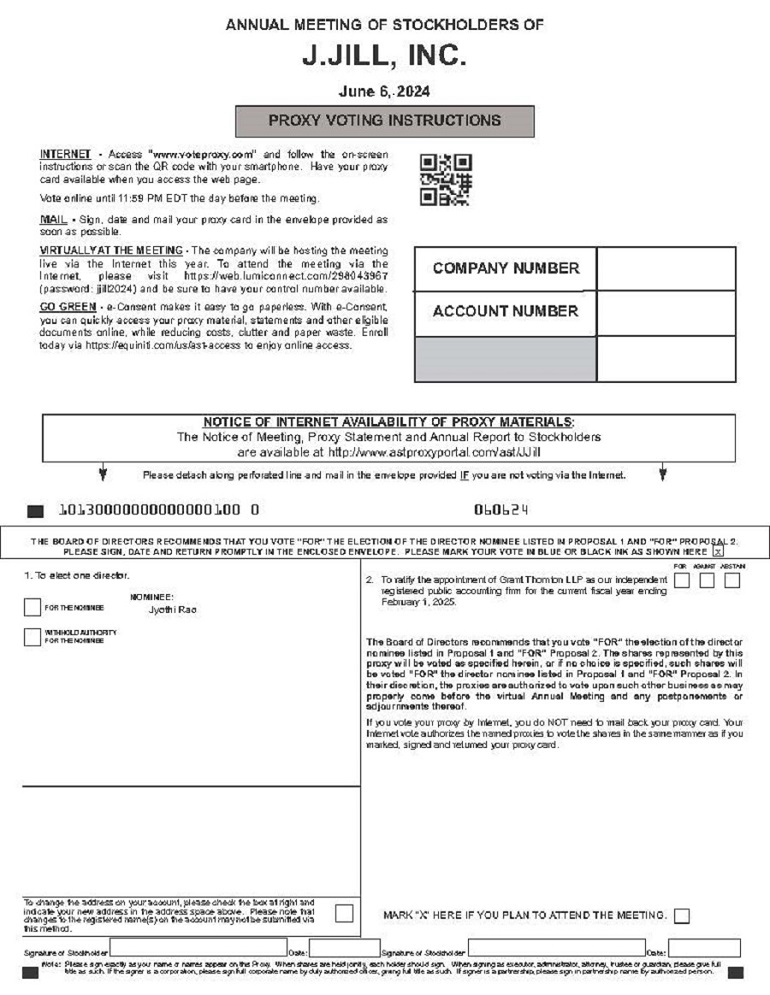

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

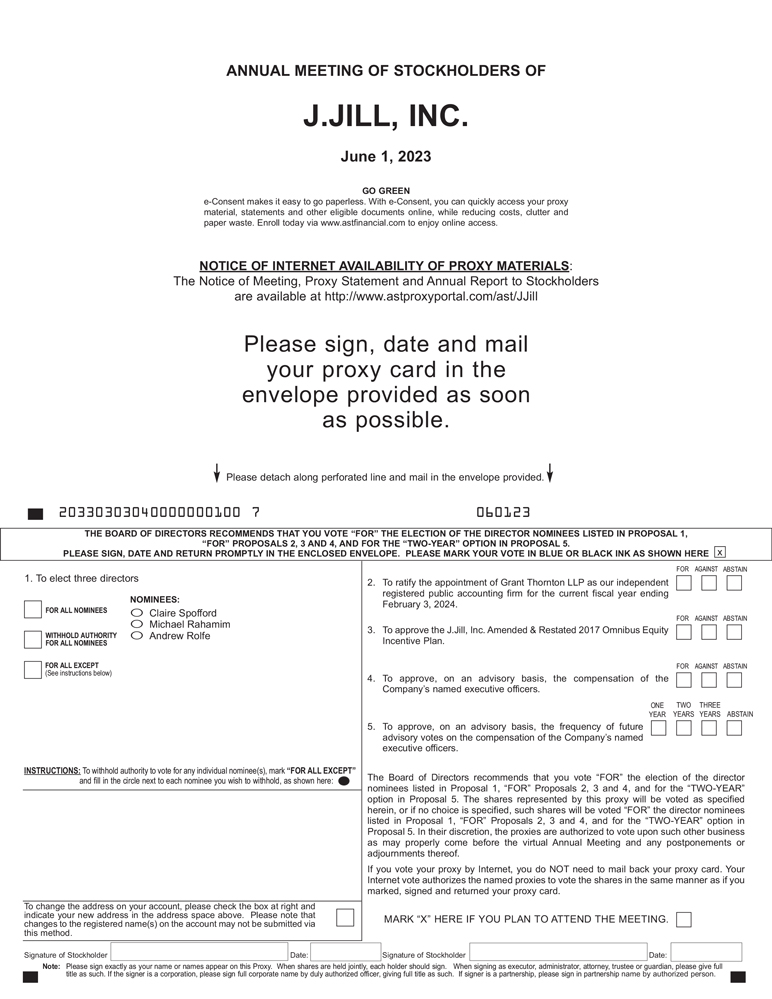

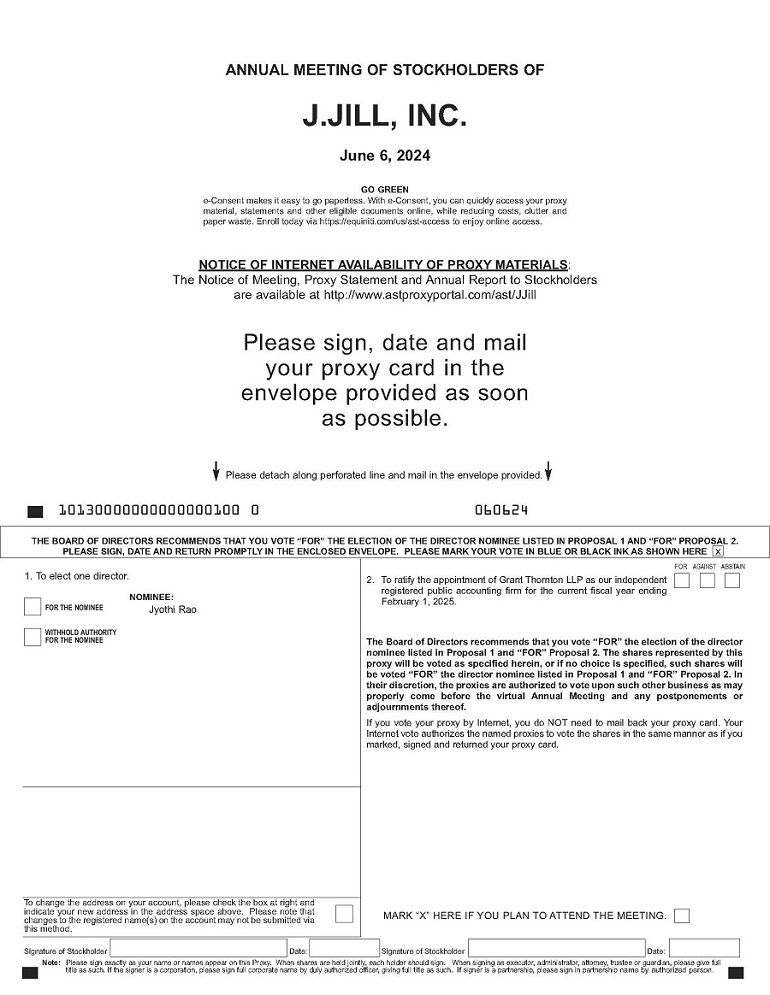

TO BE HELD JUNE 1, 20236, 2024

To the Stockholders of J.Jill, Inc.:

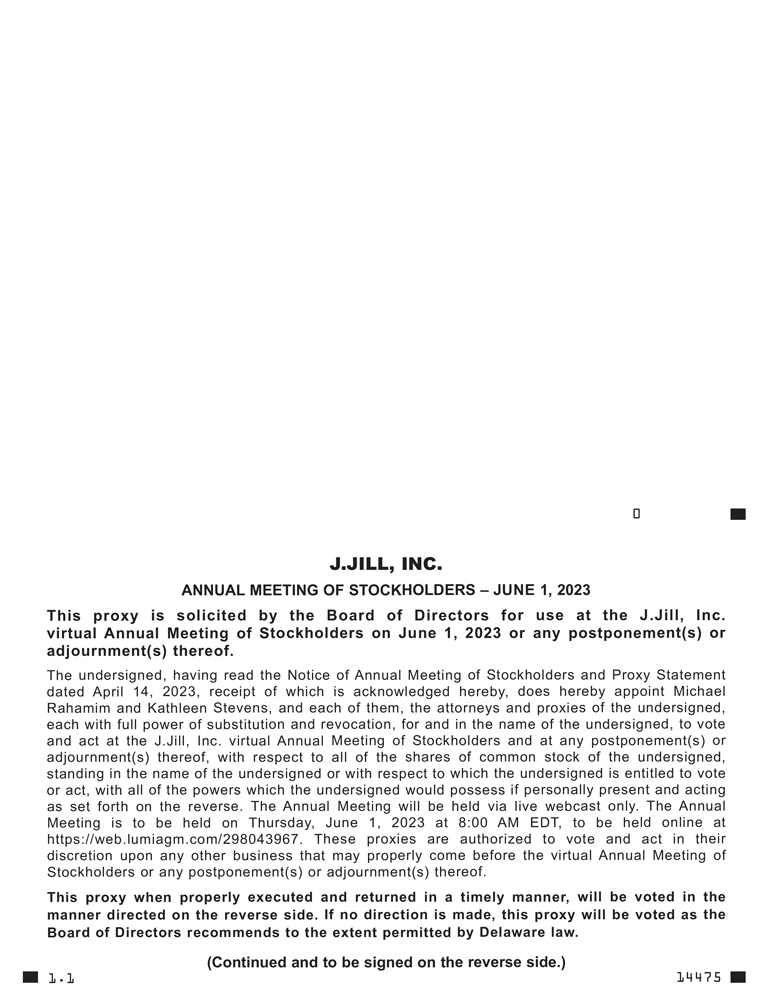

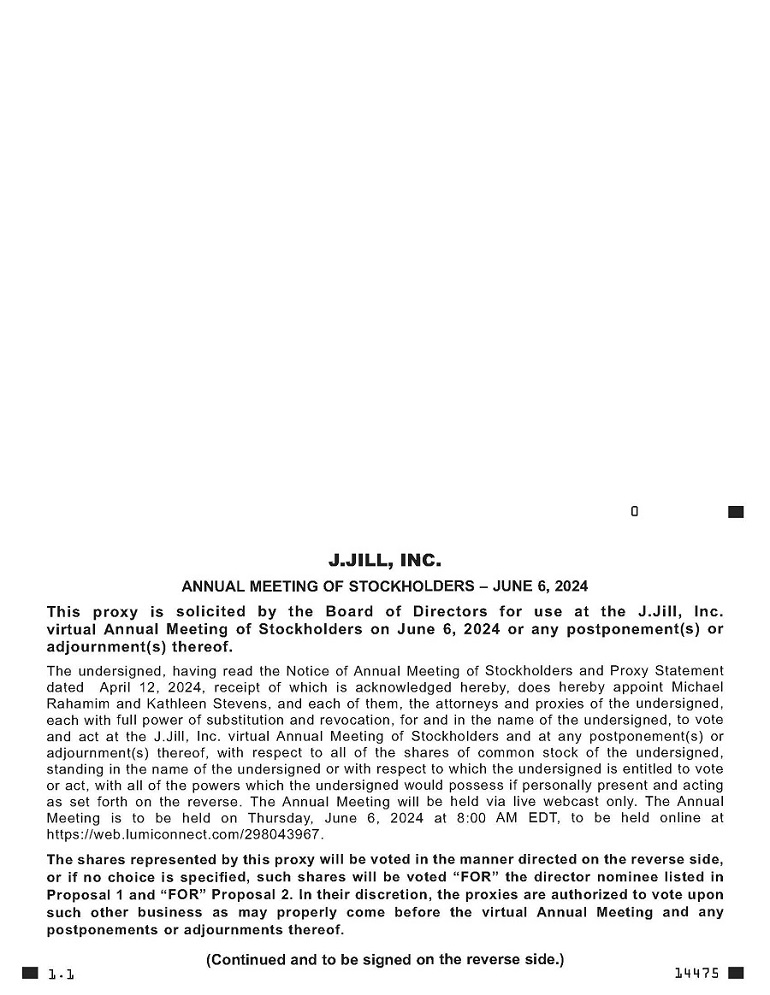

Notice is hereby given that the Annual Meeting of Stockholders of J.Jill, Inc. (the “Company,” “J.Jill” or “we”) is to be held on Thursday, June 1, 20236, 2024 at 8:00 AM Eastern, to be held online at https://web.lumiagm.com/298043967 (the “Annual Meeting”). The meetingAnnual Meeting is called for the following purposes:

1. To elect three directorsone director to our Board of Directors (the “Board of Directors”), to serve as Class III directorsI director for a term of three years expiring at the Annual Meeting of Stockholders to be held in 20262027 and until such director’s successor has been duly elected and qualified;

22. To ratify the appointment of Grant Thornton LLP (“Grant Thornton”) as our independent registered public accounting firm for the current fiscal year ending February 3, 2024;1, 2025; and

3. To approve the J.Jill, Inc. Amended & Restated 2017 Omnibus Equity Incentive Plan (the “A&R Plan”);

4. To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement;

5. To approve, on an advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers; and

6. To consider and take action upon such other matters as may properly come before the meeting or any adjournment or postponement thereof.

These matters are more fully described in the Proxy Statement accompanying this Notice.

If you were a stockholder of record of J.Jill, Inc. common stock as of the close of business on April 4, 2023,9, 2024, you are entitled to receive this Notice and vote at the Annual Meeting and any adjournments or postponements thereof, provided that our Board of Directors may fix a new record date for an adjourned meeting. Our stock transfer books will not be closed. A list of the stockholders entitled to vote at the Annual Meeting may be examined at our principal executive offices in Quincy, Massachusetts during ordinary business hours or on a reasonably accessible electronic network as provided by applicable law in the 10-day period preceding the meeting for any purposes related to the meeting.

We are pleased to take advantage of the Securities and Exchange Commission (the “SEC”) rules that allow us to furnish these proxy materials (including an electronic Proxy Card for the meeting) and our 20222023 Annual Report to Stockholders (including our Annual Report on Form 10-K for the fiscal year ended January 28, 2023)February 3, 2024 (“Fiscal Year 2023”)) to our stockholders via the Internet. On or about April 20, 2023,25, 2024, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and 20222023 Annual Report to Stockholders and how to vote. We believe that posting these materials on the Internet enables us to provide our stockholders with the information they need to vote more quickly, while lowering the cost and reducing the environmental impact of printing and delivering annual meeting materials.

i